On 11 Mar 2021, an anonymous buyer identified as "Metakovan", bought a digital art piece called "Beeple’s Everydays — The First 5,000 Days" at Christie's, for a record price of US$69.3m. The anonymity and the crazy price made for attention grabbing newsbites for the next few days. What is more difficult to understand is, the buyer is not buying the physical paintings, but a digital image of it. Eventually, Vignesh Sundaresan revealed he is "Metakovan". What price art, or is it the Art of the Scam?

The Art :

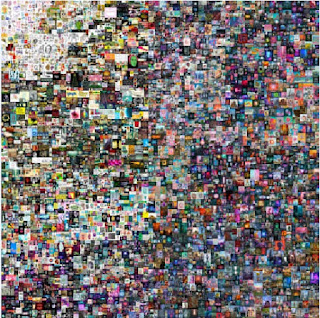

The digital art is a collage, or mosaic, of paintings by Mike Winkelmann, the artist better known by his handle 'Beeple'. He painted one picture a day and posted it on his website for 13 years. This collage is a huge image file of 21,069 by 21,069 pixels. Visit his website here and have a feel for his ourvre. I find them mostly repulsive, tasteless, indecorous, smutty, vulgar, infernal, .... I could add more, but you get the idea. They call this cult art, I think. Did Vignesh even checked the webside for a preview of what he was bidding for? Well a close friend and business partner, Anand Venkateswaran, said he did not and that it was actually not necessary. There goes the art for art sake thing.

To appreciate what Vignesh is up to, you need to understand something called NFT. The crypto ecosystem has widened its space from coins, to Defi, or Decentralised Finance, to NFT or Non-Fungible Tokens.

What is NFT? :

NFT is a new way for digitised art to be tokenised and owned in the metaverse. This is a way to assist artists to sell their paintings and musical works digitally, amongst other applications. Imagine an artist paints his version of Monalisa, digitise it, publish somewhere in the internet. He signs up with Ethereum, the cypto-currency issuer, which provides an NFT platform. Ethereum is at the forefront at the moment with its open source ERC721 standard for NFT. The artist mints the token he calls Lisa101.

Lisa101 is a non-fungible token. This means it is a unique token. Unlike Bitcoin, or US$ currency, which are fungible in that they can be broken down into various values of the same. A US$100 note can be broken down in 10 US$10 notes.

Using ERC721 means Lisa101 token is now managed on Ethereum's blockchain. The artist does not have to bother with the infrastructure. He can then sell the token at crypto exchanges. And so Lisa101 can be bought and sold at crypto exchanges. Each time it is traded, the artist earns royalty, giving him a passive income. The blockchain technology thus provides authentication as smart contracts and tracks the history of the NFT.

Note that the artist is not selling his physical painting. All that he is selling is access to his digital file. What the buyer gets is simply access to view and marvel the digital work. The NFT in this case, is simply an authentication key that points the holder to where the file is located and can be viewed. Buyer holds the NFT as investment, or for the bragging-right to the digital art, which he can copy and use for other purposes.

NFT does nothing to further provenance. Art galleries have an important job of authenticating paintings, keeping track of its history and ownership. With NFT, anyone can make a copy of the real Monalisa and mint his own token.

Vignesh and B.20:

Earlier in Dec 2020, Vignesh had purchased from the same Beeple, a collection of 20 digital images of his artworks for US$2.2 million. He created the NFT for this. The token is called the B20 and the project he called the B.20. Vignesh has differentiated this NFT in 4 ways.

Firstly, he housed the digital art pieces in some virtual real estate sites Decentraland, Somnium Space and Cryptovoxels.

Secondly, he built a virtual world somewhat like a museum, with fine architecture, and original music, so as to enhance the experience of visitors.

Thirdly, he had the NFT fractionalised into 10,000,000 tokens. So he basically minted 10 million B20 tokens. Anyone who purchases a B20 token can access the site. He has basically made his Non-Fungible Token fungible.

Lastly, and most importantly, he built a DAO, or decentralised autonomous organisation, which are rules that allow the system to execute certain actions autonomously.

This is what differentiates Vignesh's model. It can be likened to a condominium. B20 token holders are the unit holders, and B.20 is the MCST or management corporation strata title. B20 token holders have a right to visit the virtual museun and trade their tokens. They own a fraction of B.20. The virtual musuem and the rights of the digital art is owned by Vignesh.

So how is B20 doing? :

Of the 10 million tokens, 59% is held by Vignesh's Metapurse Fund, 2% allocated graciously to take care of the artist, 16% public sale, and the rest allocated to other stakeholders. Total cost for setting up B.20 was US$3.6 million. B20 was priced at US$0.36 which is the cost of setting up B.20. What this means is Vignesh can trade the B20 tokens that he holds just like all other holders, but he alone can exit and dispose the B.20 which is basically the one with the master key to the Beeple "Everydays" NFT.

It made an impressive start to hit a high of US$27.35 on Mar 11 and then it was downhill all the way, flatting out to US$0.67 end of June. Had Beeple exit at the top, his 200,000 tokens would have profited him US$5.4 million. Adding to his sale of US$2.2 million, he would have collected a cool US$7.6 million for 20 digital images, and still retain ownership of the physical art pieces. Not bad at all.

As it stands, B20 has tanked.

His business partner Anand Venkateswaran, had mentioned they were open to selling the project, that is B.20, for around US$58 million. So it seems that had been the business plan. Build it, then dispose at the right price. There is nothing wrong with that. But so much for appreciation of art in the metaverse.

The US$69.3 million purchase:

It would appear B20 is a dry run for a more ambitious NFT. The next asset acquisition has to be an impressively big deal. So he headed to Christie's, and met a challenge from Justin Sun, crypto magnate CEO of the cryptocurrency platform Tron. Sun was in the process of starting his own "Just NTF Fund". Coincidentally, Sun was later to start his first NFT also using the cult artist Beeple's work called "Ocean Front" which he paid US$6 million. Sun had been buying works of traditional artist names like Picaso and Warhol.

The Vignesh-Sun bidding war pushed "Everydays" price to US$69.3 million. But was that a real bidding war? All 3 actors, Vignesh, Sun and Beeple, have the same interest for an audacious price to build publicity for the nascent NFT industry. One wonders. Surely, an investor needs some means of valuation. For unknown art, how did Vignesh put a value on Beeple's "Everydays"? Particularly, as his associate mentioned, he did'nt even preview the art piece.

So how was the Christie deal settled? It appears payment was by cryptocurrency ether. Based on the prevailing rate, there should have been a transfer of about ETH 42 million. No such large transaction was observed, but it could have been transacted in ways that do not show up. Vignesh had professed to be a successful crypto guy for many years. If he had been an early investor in Ether, then it's possible that he has built a vast hoard of cryptos.

Who is Vignesh Sundaresan? :

In his website, he self-described himself as "entrepreneur, coder and angel investor" in blockchain technology. He is 32 years old and hails from Tamil Naidu, India.

Apparently a very intelligent and geeky chap very much into the metaverse world of virtual realities, virtual currencies and NFTs. Obviously he is not alone. There is a parallel population who likes to live in the Matrix and live by fanciful handles -- Vignesh is 'Metakovan', Anand is "Twobadour", and Mike the artist is "Beeple".

Vignesh did his college in UAE and his master in Canada. While pursuing his master, he founded 2 start-ups.

1. Coins-e, a crypto-exchange platform, in 2013. Coins-e seems to have complaints by users of lost coins and scams and was a one-man operation. Vignesh claimed he sold Coins-e in 2014 to a newly incorporated company called Casa Crypto Inc and events after his divestment has nothing to do with him. Part of the consideration for the sales seems to be the issue of 15% new shares in Casa Crypto to Vignesh, thus he cannot waive responsibility of post sales wrong-doing. Both companies are not on Wikipedia, have no websites. They have disappeared. My request to the law firm that handled the sales have received no confirmation todate.

2. Bitaccess which makes BTMs, or Bitcoin Teller Machines, and reportedly used in 15 countries. His profile descriptions, which pop up everywhere, mentions his startup Bitaccess with seed capital from a Canadian tech accelerator called Y-Combinator. He does not mention Bitaccess had 3 other co-founders, Haseeb Awan, Moe Adham, and Ryan Wallace.

To appreciate what Vignesh is up to, you need to understand something called NFT. The crypto ecosystem has widened its space from coins, to Defi, or Decentralised Finance, to NFT or Non-Fungible Tokens.

What is NFT? :

NFT is a new way for digitised art to be tokenised and owned in the metaverse. This is a way to assist artists to sell their paintings and musical works digitally, amongst other applications. Imagine an artist paints his version of Monalisa, digitise it, publish somewhere in the internet. He signs up with Ethereum, the cypto-currency issuer, which provides an NFT platform. Ethereum is at the forefront at the moment with its open source ERC721 standard for NFT. The artist mints the token he calls Lisa101.

Lisa101 is a non-fungible token. This means it is a unique token. Unlike Bitcoin, or US$ currency, which are fungible in that they can be broken down into various values of the same. A US$100 note can be broken down in 10 US$10 notes.

Using ERC721 means Lisa101 token is now managed on Ethereum's blockchain. The artist does not have to bother with the infrastructure. He can then sell the token at crypto exchanges. And so Lisa101 can be bought and sold at crypto exchanges. Each time it is traded, the artist earns royalty, giving him a passive income. The blockchain technology thus provides authentication as smart contracts and tracks the history of the NFT.

Note that the artist is not selling his physical painting. All that he is selling is access to his digital file. What the buyer gets is simply access to view and marvel the digital work. The NFT in this case, is simply an authentication key that points the holder to where the file is located and can be viewed. Buyer holds the NFT as investment, or for the bragging-right to the digital art, which he can copy and use for other purposes.

NFT does nothing to further provenance. Art galleries have an important job of authenticating paintings, keeping track of its history and ownership. With NFT, anyone can make a copy of the real Monalisa and mint his own token.

Vignesh and B.20:

Earlier in Dec 2020, Vignesh had purchased from the same Beeple, a collection of 20 digital images of his artworks for US$2.2 million. He created the NFT for this. The token is called the B20 and the project he called the B.20. Vignesh has differentiated this NFT in 4 ways.

Firstly, he housed the digital art pieces in some virtual real estate sites Decentraland, Somnium Space and Cryptovoxels.

Secondly, he built a virtual world somewhat like a museum, with fine architecture, and original music, so as to enhance the experience of visitors.

Thirdly, he had the NFT fractionalised into 10,000,000 tokens. So he basically minted 10 million B20 tokens. Anyone who purchases a B20 token can access the site. He has basically made his Non-Fungible Token fungible.

Lastly, and most importantly, he built a DAO, or decentralised autonomous organisation, which are rules that allow the system to execute certain actions autonomously.

This is what differentiates Vignesh's model. It can be likened to a condominium. B20 token holders are the unit holders, and B.20 is the MCST or management corporation strata title. B20 token holders have a right to visit the virtual museun and trade their tokens. They own a fraction of B.20. The virtual musuem and the rights of the digital art is owned by Vignesh.

So how is B20 doing? :

Of the 10 million tokens, 59% is held by Vignesh's Metapurse Fund, 2% allocated graciously to take care of the artist, 16% public sale, and the rest allocated to other stakeholders. Total cost for setting up B.20 was US$3.6 million. B20 was priced at US$0.36 which is the cost of setting up B.20. What this means is Vignesh can trade the B20 tokens that he holds just like all other holders, but he alone can exit and dispose the B.20 which is basically the one with the master key to the Beeple "Everydays" NFT.

It made an impressive start to hit a high of US$27.35 on Mar 11 and then it was downhill all the way, flatting out to US$0.67 end of June. Had Beeple exit at the top, his 200,000 tokens would have profited him US$5.4 million. Adding to his sale of US$2.2 million, he would have collected a cool US$7.6 million for 20 digital images, and still retain ownership of the physical art pieces. Not bad at all.

As it stands, B20 has tanked.

His business partner Anand Venkateswaran, had mentioned they were open to selling the project, that is B.20, for around US$58 million. So it seems that had been the business plan. Build it, then dispose at the right price. There is nothing wrong with that. But so much for appreciation of art in the metaverse.

The US$69.3 million purchase:

It would appear B20 is a dry run for a more ambitious NFT. The next asset acquisition has to be an impressively big deal. So he headed to Christie's, and met a challenge from Justin Sun, crypto magnate CEO of the cryptocurrency platform Tron. Sun was in the process of starting his own "Just NTF Fund". Coincidentally, Sun was later to start his first NFT also using the cult artist Beeple's work called "Ocean Front" which he paid US$6 million. Sun had been buying works of traditional artist names like Picaso and Warhol.

The Vignesh-Sun bidding war pushed "Everydays" price to US$69.3 million. But was that a real bidding war? All 3 actors, Vignesh, Sun and Beeple, have the same interest for an audacious price to build publicity for the nascent NFT industry. One wonders. Surely, an investor needs some means of valuation. For unknown art, how did Vignesh put a value on Beeple's "Everydays"? Particularly, as his associate mentioned, he did'nt even preview the art piece.

So how was the Christie deal settled? It appears payment was by cryptocurrency ether. Based on the prevailing rate, there should have been a transfer of about ETH 42 million. No such large transaction was observed, but it could have been transacted in ways that do not show up. Vignesh had professed to be a successful crypto guy for many years. If he had been an early investor in Ether, then it's possible that he has built a vast hoard of cryptos.

Who is Vignesh Sundaresan? :

In his website, he self-described himself as "entrepreneur, coder and angel investor" in blockchain technology. He is 32 years old and hails from Tamil Naidu, India.

Apparently a very intelligent and geeky chap very much into the metaverse world of virtual realities, virtual currencies and NFTs. Obviously he is not alone. There is a parallel population who likes to live in the Matrix and live by fanciful handles -- Vignesh is 'Metakovan', Anand is "Twobadour", and Mike the artist is "Beeple".

Vignesh did his college in UAE and his master in Canada. While pursuing his master, he founded 2 start-ups.

1. Coins-e, a crypto-exchange platform, in 2013. Coins-e seems to have complaints by users of lost coins and scams and was a one-man operation. Vignesh claimed he sold Coins-e in 2014 to a newly incorporated company called Casa Crypto Inc and events after his divestment has nothing to do with him. Part of the consideration for the sales seems to be the issue of 15% new shares in Casa Crypto to Vignesh, thus he cannot waive responsibility of post sales wrong-doing. Both companies are not on Wikipedia, have no websites. They have disappeared. My request to the law firm that handled the sales have received no confirmation todate.

2. Bitaccess which makes BTMs, or Bitcoin Teller Machines, and reportedly used in 15 countries. His profile descriptions, which pop up everywhere, mentions his startup Bitaccess with seed capital from a Canadian tech accelerator called Y-Combinator. He does not mention Bitaccess had 3 other co-founders, Haseeb Awan, Moe Adham, and Ryan Wallace.

Vignesh relocated to Singapore in 2017 for reasons he said, of a better regulatory environment. He has 3 companies here - Porkey Technologies, Metapurse Fund and Lendroid Foundation.

Portkey Technologies, Singapore, is an information technology consulting firm. It's website is very basic and shows some high-end IT consultancy services. There are however, zero references. We have no idea of what work they are doing, headcount, etc. Linkedin search shows up nothing.

Metaverse Fund, Singapore, is Vignesh's own investments into metaverse projects. B.20 being the only one at the moment, which he considers as his Genesis NFT, meaning more to come. The website throws up a smorgasbord of metaverse and crypto terms and acronyms draped in techno talk of their dreams and causes but explains nothing.

Lendroid Foundation, Silngapore, is developing a Defi project. Defi stands for Decentralised Finance which is sort of a crypto lending/borrowing platform. Since 2017 it has not been able to list its own token called LST, or Lendroid Support Token, on any crypto exchange.

Conclusion :

NFT is under the radar of FATF, the Financial Action Task Force, a global anti-money laundering watchdog. They see big money coming from mysterious people to buy outrageously overpriced NFTs with cryptocurrency which can then can be traded and converted into fiat. This is not to say Vignesh's projects are suspect, but the nascent industry of NFT has real concerns. Perhaps for people like me who lives in the real world, it's a nerve wreck to process the idea that US$69.3m for an image file is money well spent. In 1987, Japanese insurance magnate Yasuo Goto, paid a record breaking US$40m for Van Gogh's "Vase with Fifteen Sunflowers" at a Christie's auction. He can hang the real physical painting on a wall at his residence and admire it to death. That at least, I can understand.