Congratulations to the newly-elected Philippines president Bong Bong Marcos (BBM) who will present his first State Of Nation Address on July 25. Will his ascendancy bring back the pomposity and ostentatious show in his father's days when SONA brought out the politicians and guests to challenge the Hollywood Academy Award nights. Or will it be subdued and serious given the pandemic and the headwinds of inflation and food shortages. In times of difficulties, such as current days, the leader must give the people a sense of hope. We await his speech that should basically assess the situation of the nation, and his wisdom of how his admin will advance the country.

In assessing the economics landscape, the data surely will be an indictment of President Rodrigo Duterte. Will BBM bravely review in public the data with his Vice President Sarah by his side, who is non-other than the daughter of Duterte.

1. Current Account:

The Current Accounts of the country shows the country's trade relationship with the rest of the world. Without going into the details, this records the movement of trade in goods and services, interest on loans, private transfers. A net credit is normally called a trade surplus, a net debit a trade deficit. A trade surplus means there is a net inflow of funds into the country, a net deficit means an outflow of funds.

BBM's father, President Ferdinand Marcos, had left Philippines a legacy of trade deficits since 1986 which Presidents Cory Aquino, Fidel Ramos and Joseph Estrada could not overcome. Credit to Gloria Arroyo, an economist, who managed to swing the country back to a trade surplus. Pnoy Aquino maintained the surplus levels. Under Duterte, Philippines slipped back into a trade deficit mode. Duterte gifted BBM a trade deficit of almost US$3 billion.

2. The exchange rate:

The exchange rate appreciation or depreciation is a double-edged sword. A depreciation is good for the folks receiving remittances from overseas which convert to more pesos, importers pay more for their overseas purchase, but Philippines exports becomes cheaper and more competitive. If the peso appreciates, the remittances coming home convert to lesser cash, imports become cheaper and exports more expensive. What Bangko Sentral seeks to maintain, is price stability. Nobody wants volatility in the rates.

Trade deficit means a net outflow of funds. As more Pesos are sold for foreign currencies to pay for more imports, the consequence is downward pressure on the exchange rate. Pnoy Aquino started with the rate at about USD1 : PHP46,000 The rate appreciated by about 10% and slipped back to 46.0. Duterte's admin saw the pesos depreciate by about 21.8% to 1:51,000.

As can be seen in the 2 charts above, the exchange rate moves in sync with the current account status. This makes sense as the net cash inflows and outflows impact the rate. Duterte's trade deficits weakened the peso, imported inflation and strained external debt servicing.

3. External Debt:

A Balance of Payments records a country's cross border monetary relationship with the rest of the world. Very briefly, it is split into 2 parts. The first part is the Current Account, shown above. The second part is called the Capital Account which records inflows and outflows on capital and financial transactions, such as borrowings/lendings, FDI. A deficit or surplus in the Current Account with be balanced off by a reverse sum in the Capital Account, thus the Balance of Payments will technically be zero. A simple example - if a country has a deficit Current Account, it ends up with a foreign loan to pay for the cash outflows. The Current Account has an outflow because of net imports, balanced off by cash inflow from loan that appears in the Capital Account.

All the Current Account deficits of Duterte means there were net outflow of funds. Where are the funds coming from? From external loans of course. The chart above shows Aquino kept the external debt flat but Duterte built up the foreign currency debts. Duterte gifted BBM additional PHP1.5 trillion of foreign debt.

Duterte's fiscal policies also increased domestic debt by Php 4 trillion. Overall, Durterte exploded national debt by 100% to Php 12 trillion. With the world going into an interest rate war, it is the huge external debt that will challenge BBM.

4. Interest Rates:

Exchange rate regimes manage price levels (inflation) by intervening in the FX market to manage rates. A trade surplus has upward pressure on the rates, so the central bank mops up the foreign currencies to force rates down. On the other hand in a trade deficit the central bank buys domestic currencies to force the rates up. This central bank action is easily reflected in their balance sheet.

Philippines follows the US way using interest rates and QE/QT (quantitative easing/quantitative tightening) as the tools for monetary management. The effects of changes on interest rates is not easily seen in the balance sheet. However, QE/QT are reflected in the balance sheet.

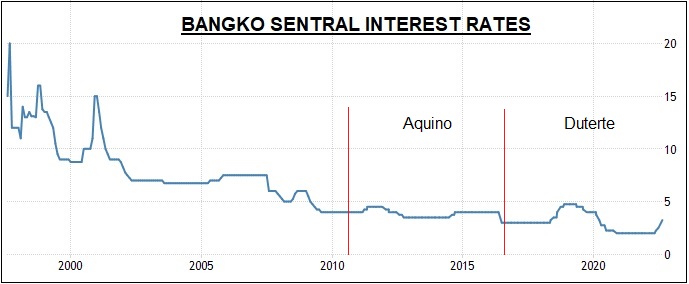

The chart above shows Philippines have a similar extended downward trend on interest rates like almost all countries. Aquino admin managed to hold interest rates steady for 6 years. This at a time when exchange rate was stronger. In Duterte's admin, the trade deficit of 2018 caused peso to depreciate, which is inflationary, and Bangko Sentral reacted by increasing interest rates about 200 basis points which in turn caused peso to appreciate again.

BBM takes over a sustained trade deficit which will depreciate the peso further unless the new president is able to improve the trade figures. A depreciating peso is inflationary. This time round, the situation is exacerbated by the acts of trading partners which are exchange rate regimes, like Singapore and China. These countries with trade surpluses will tighten monetary controls, allowing their exchange rates to appreciate to fight inflation. In other words, peso interest rates need to work double hard. Bangko Sentro has already increased interest rates recently. It is poised to go much higher. Trying to improve trade figures by raising interest and exchange rates is a tough order. You can't increase production cost and higher export prices and yet remain competitive.

5. Philippines foreign reserves:

One key metric that throws some light on the resilience of Philippines and its banking system is the level of its official foreign reserves. We can see this in Bangko Sentral's balance sheet which also shows what funded the reserves.

Every country needs to maintain a certain level of foreign reserves to withstand a credit crunch. The World Bank recommends a level to sustain 5-6 months of imports.

The Aquino admin added about US$1 billion to the country's reserves. Philippines reserves have been on the rise. Where did the money come from to purchase the foreign currencies? By debt (reverse repos and special term deposits - meant to reduce market liquidity) and some currency note printing.

Under Duterte, his appointee CEO of Bangko Sentral, Benjamin Diokno, further increased reserves by about USD1.3 billion, bringing the total to about USD5.5 billion. Diokno's reserve purchases were funded by massive currency note printing and government deposits. Where are the huge government deposits coming from - increased domestic debt as shown in the national debt chart. Currency assets carry a valuation risks. Diokno's reserves now carry a huge unrealised revaluation loss due to apppreciation of peso. As at Mar 2022, this unrealised loss stands at USD588 million.

6. Reserves to GDP ratio :

Diokno likes to boast of the country's financial resilience with building up of the foreign reserves. But aggregates do not tell the full picture. The reserves of USD5.5B may be a very big sum, but it runs out very quickly during a credit crunch. When that happens, companies and the government go into default because the banking system cannot provide the foreign currencies for them to service their external debts. Are Diokno's reserves adequate? As economies grow, the level of foreign reserves must grow too. A better guage of reserve adequacy is to look at the Reserves to GDP ratio.

Estrada raided the reserves which plunged to its lowest level ever about 12% of GDP. Arroyo did well to bring it up to 20% level, whilst Aquino was quite consistent at the 20% level. Here comes Duterte and the reserves dropped to equal Estrada's lowest at 12%. For comparison, Switzerland has the highest ratio in the world at 115%. Singapore was at 105% before it moved some reserves to its sovereign wealth fund recently which brought the figure down to 91%.

A low level of foreign reserves heightens risks to a credit crunch just like what happened to Thailand, Malaysia and Indonesia in the 1997 Asian financial crisis. A central bank's inability to provide foreign currency liquidity in a credit crunch subjects the country's banking system to great risks.

Summary :

Basically, the state of the nation is shaky. Trade deficits mean a depreciating peso which means importing inflation. Diokno has started moving interest rate up to protect the peso. But higher interest cost is no good for business. The inflation in Philippines is not driven by high liquidity or a demand side pressure. It is due to supply side loss of production resources. It is a situation that raising interest rates cannot address.

In all fairness, the central bank do not take all the blame. Although its monetary function is independent of the Executive, it had to work in cooperation with fiscal policies. Duterte is responsible for all the negative metrics mentioned. The trade deficit and huge external debt is a consequence of his infra 'Build Build Build' policy. There is a time lapse before hardcore infras can translate into more market efficiency and contribute to economy. The problem is the infras do not seem to be visible. Will BBM suffer the consequences or reap the benefits of his predecessor's infras programmes?

The downfall of Ferdinand Marcos in 1986 was hugely due to the country's debt position that could not take the shock of Paul Volcker's massive Fed rates applied on the USD which peaked at 21% p.a.. In our present times, a global interest rate war looms - the days of near-zero interest rates are over. There is fear Fed Chair Jerome Powell may be forced to use a Volcker style high extreme rates approach to tame their 9.1% inflation. History may repeat itself in Philippines. The son now takes over a massive foreign debt and faces a threatening interest rate shock.

If BBM's first act portends what's to come, it's time to buckle up for a rough ride. He acts on the clarion call of Diokno to kick start a digital financial infra with a new USD300m loan. One would have thought the priority is food production in view of the supply chain problems in the world and seriously take heed of the World Bank's warning of an impending human catastrophe food crisis .

I wish the new president and my beloved Philippines well. Despite my personal misgivings of the family name, I feel we should respect the vote and let BBM the opportunity to work for the people as best he could. There is only one area that I really hope he will never go. And that unfortunately, seems to be one of his favourite calls. I am referring to the revival of the failed and decaying Bataan Nuclear Power Plant. He seems adamant on fulfilling his father's legacy. Although I live 2,350 km away, I recall the 1991 Mount Pinatubo eruption blocked out the sun and wind blown volcanic dust reached our shores. The plant is rusting away, it's only 57 km from Pinatubo and along Philippines earthquake fault lines.

In assessing the economics landscape, the data surely will be an indictment of President Rodrigo Duterte. Will BBM bravely review in public the data with his Vice President Sarah by his side, who is non-other than the daughter of Duterte.

1. Current Account:

The Current Accounts of the country shows the country's trade relationship with the rest of the world. Without going into the details, this records the movement of trade in goods and services, interest on loans, private transfers. A net credit is normally called a trade surplus, a net debit a trade deficit. A trade surplus means there is a net inflow of funds into the country, a net deficit means an outflow of funds.

BBM's father, President Ferdinand Marcos, had left Philippines a legacy of trade deficits since 1986 which Presidents Cory Aquino, Fidel Ramos and Joseph Estrada could not overcome. Credit to Gloria Arroyo, an economist, who managed to swing the country back to a trade surplus. Pnoy Aquino maintained the surplus levels. Under Duterte, Philippines slipped back into a trade deficit mode. Duterte gifted BBM a trade deficit of almost US$3 billion.

2. The exchange rate:

The exchange rate appreciation or depreciation is a double-edged sword. A depreciation is good for the folks receiving remittances from overseas which convert to more pesos, importers pay more for their overseas purchase, but Philippines exports becomes cheaper and more competitive. If the peso appreciates, the remittances coming home convert to lesser cash, imports become cheaper and exports more expensive. What Bangko Sentral seeks to maintain, is price stability. Nobody wants volatility in the rates.

Trade deficit means a net outflow of funds. As more Pesos are sold for foreign currencies to pay for more imports, the consequence is downward pressure on the exchange rate. Pnoy Aquino started with the rate at about USD1 : PHP46,000 The rate appreciated by about 10% and slipped back to 46.0. Duterte's admin saw the pesos depreciate by about 21.8% to 1:51,000.

As can be seen in the 2 charts above, the exchange rate moves in sync with the current account status. This makes sense as the net cash inflows and outflows impact the rate. Duterte's trade deficits weakened the peso, imported inflation and strained external debt servicing.

3. External Debt:

A Balance of Payments records a country's cross border monetary relationship with the rest of the world. Very briefly, it is split into 2 parts. The first part is the Current Account, shown above. The second part is called the Capital Account which records inflows and outflows on capital and financial transactions, such as borrowings/lendings, FDI. A deficit or surplus in the Current Account with be balanced off by a reverse sum in the Capital Account, thus the Balance of Payments will technically be zero. A simple example - if a country has a deficit Current Account, it ends up with a foreign loan to pay for the cash outflows. The Current Account has an outflow because of net imports, balanced off by cash inflow from loan that appears in the Capital Account.

All the Current Account deficits of Duterte means there were net outflow of funds. Where are the funds coming from? From external loans of course. The chart above shows Aquino kept the external debt flat but Duterte built up the foreign currency debts. Duterte gifted BBM additional PHP1.5 trillion of foreign debt.

Duterte's fiscal policies also increased domestic debt by Php 4 trillion. Overall, Durterte exploded national debt by 100% to Php 12 trillion. With the world going into an interest rate war, it is the huge external debt that will challenge BBM.

4. Interest Rates:

Exchange rate regimes manage price levels (inflation) by intervening in the FX market to manage rates. A trade surplus has upward pressure on the rates, so the central bank mops up the foreign currencies to force rates down. On the other hand in a trade deficit the central bank buys domestic currencies to force the rates up. This central bank action is easily reflected in their balance sheet.

Philippines follows the US way using interest rates and QE/QT (quantitative easing/quantitative tightening) as the tools for monetary management. The effects of changes on interest rates is not easily seen in the balance sheet. However, QE/QT are reflected in the balance sheet.

The chart above shows Philippines have a similar extended downward trend on interest rates like almost all countries. Aquino admin managed to hold interest rates steady for 6 years. This at a time when exchange rate was stronger. In Duterte's admin, the trade deficit of 2018 caused peso to depreciate, which is inflationary, and Bangko Sentral reacted by increasing interest rates about 200 basis points which in turn caused peso to appreciate again.

BBM takes over a sustained trade deficit which will depreciate the peso further unless the new president is able to improve the trade figures. A depreciating peso is inflationary. This time round, the situation is exacerbated by the acts of trading partners which are exchange rate regimes, like Singapore and China. These countries with trade surpluses will tighten monetary controls, allowing their exchange rates to appreciate to fight inflation. In other words, peso interest rates need to work double hard. Bangko Sentro has already increased interest rates recently. It is poised to go much higher. Trying to improve trade figures by raising interest and exchange rates is a tough order. You can't increase production cost and higher export prices and yet remain competitive.

5. Philippines foreign reserves:

One key metric that throws some light on the resilience of Philippines and its banking system is the level of its official foreign reserves. We can see this in Bangko Sentral's balance sheet which also shows what funded the reserves.

Every country needs to maintain a certain level of foreign reserves to withstand a credit crunch. The World Bank recommends a level to sustain 5-6 months of imports.

The Aquino admin added about US$1 billion to the country's reserves. Philippines reserves have been on the rise. Where did the money come from to purchase the foreign currencies? By debt (reverse repos and special term deposits - meant to reduce market liquidity) and some currency note printing.

Under Duterte, his appointee CEO of Bangko Sentral, Benjamin Diokno, further increased reserves by about USD1.3 billion, bringing the total to about USD5.5 billion. Diokno's reserve purchases were funded by massive currency note printing and government deposits. Where are the huge government deposits coming from - increased domestic debt as shown in the national debt chart. Currency assets carry a valuation risks. Diokno's reserves now carry a huge unrealised revaluation loss due to apppreciation of peso. As at Mar 2022, this unrealised loss stands at USD588 million.

6. Reserves to GDP ratio :

Diokno likes to boast of the country's financial resilience with building up of the foreign reserves. But aggregates do not tell the full picture. The reserves of USD5.5B may be a very big sum, but it runs out very quickly during a credit crunch. When that happens, companies and the government go into default because the banking system cannot provide the foreign currencies for them to service their external debts. Are Diokno's reserves adequate? As economies grow, the level of foreign reserves must grow too. A better guage of reserve adequacy is to look at the Reserves to GDP ratio.

Estrada raided the reserves which plunged to its lowest level ever about 12% of GDP. Arroyo did well to bring it up to 20% level, whilst Aquino was quite consistent at the 20% level. Here comes Duterte and the reserves dropped to equal Estrada's lowest at 12%. For comparison, Switzerland has the highest ratio in the world at 115%. Singapore was at 105% before it moved some reserves to its sovereign wealth fund recently which brought the figure down to 91%.

A low level of foreign reserves heightens risks to a credit crunch just like what happened to Thailand, Malaysia and Indonesia in the 1997 Asian financial crisis. A central bank's inability to provide foreign currency liquidity in a credit crunch subjects the country's banking system to great risks.

Read: The debacle of USD or Yuan as world reserve currency. Why the Triffin Dilemma dictates the inevitable failure of any national currency used as world reserve. Why Yuan is unlikely to succeed its reserve ambition.

Summary :

Basically, the state of the nation is shaky. Trade deficits mean a depreciating peso which means importing inflation. Diokno has started moving interest rate up to protect the peso. But higher interest cost is no good for business. The inflation in Philippines is not driven by high liquidity or a demand side pressure. It is due to supply side loss of production resources. It is a situation that raising interest rates cannot address.

In all fairness, the central bank do not take all the blame. Although its monetary function is independent of the Executive, it had to work in cooperation with fiscal policies. Duterte is responsible for all the negative metrics mentioned. The trade deficit and huge external debt is a consequence of his infra 'Build Build Build' policy. There is a time lapse before hardcore infras can translate into more market efficiency and contribute to economy. The problem is the infras do not seem to be visible. Will BBM suffer the consequences or reap the benefits of his predecessor's infras programmes?

The downfall of Ferdinand Marcos in 1986 was hugely due to the country's debt position that could not take the shock of Paul Volcker's massive Fed rates applied on the USD which peaked at 21% p.a.. In our present times, a global interest rate war looms - the days of near-zero interest rates are over. There is fear Fed Chair Jerome Powell may be forced to use a Volcker style high extreme rates approach to tame their 9.1% inflation. History may repeat itself in Philippines. The son now takes over a massive foreign debt and faces a threatening interest rate shock.

If BBM's first act portends what's to come, it's time to buckle up for a rough ride. He acts on the clarion call of Diokno to kick start a digital financial infra with a new USD300m loan. One would have thought the priority is food production in view of the supply chain problems in the world and seriously take heed of the World Bank's warning of an impending human catastrophe food crisis .

I wish the new president and my beloved Philippines well. Despite my personal misgivings of the family name, I feel we should respect the vote and let BBM the opportunity to work for the people as best he could. There is only one area that I really hope he will never go. And that unfortunately, seems to be one of his favourite calls. I am referring to the revival of the failed and decaying Bataan Nuclear Power Plant. He seems adamant on fulfilling his father's legacy. Although I live 2,350 km away, I recall the 1991 Mount Pinatubo eruption blocked out the sun and wind blown volcanic dust reached our shores. The plant is rusting away, it's only 57 km from Pinatubo and along Philippines earthquake fault lines.

No comments:

Post a Comment

Appreciate comments that add knowledge to the subject. Please participate within bounds of civility. Admin reserves the right to moderate comments. In any exchange, seek WHAT is right, not WHO is right.